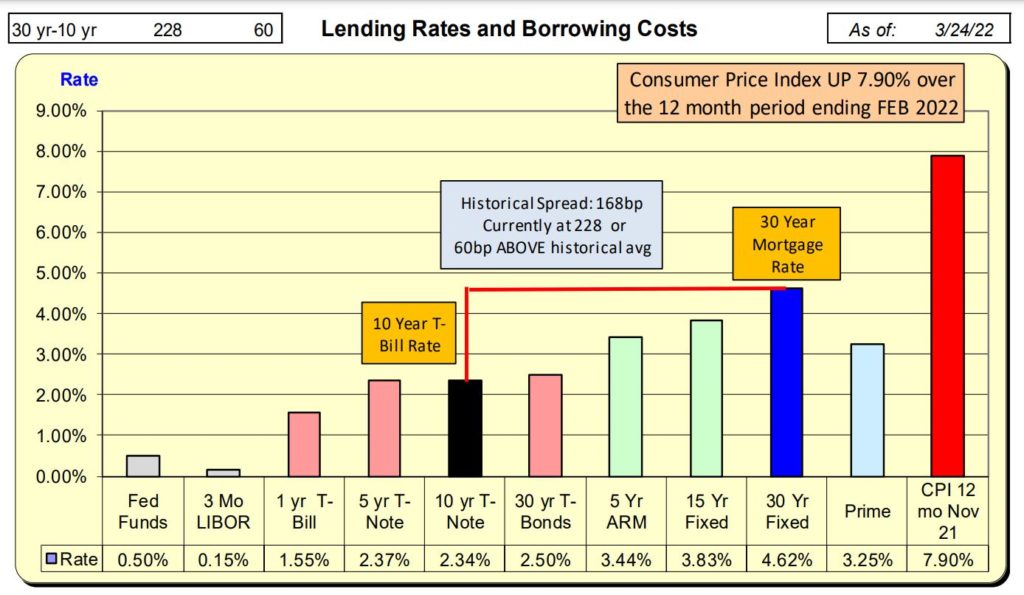

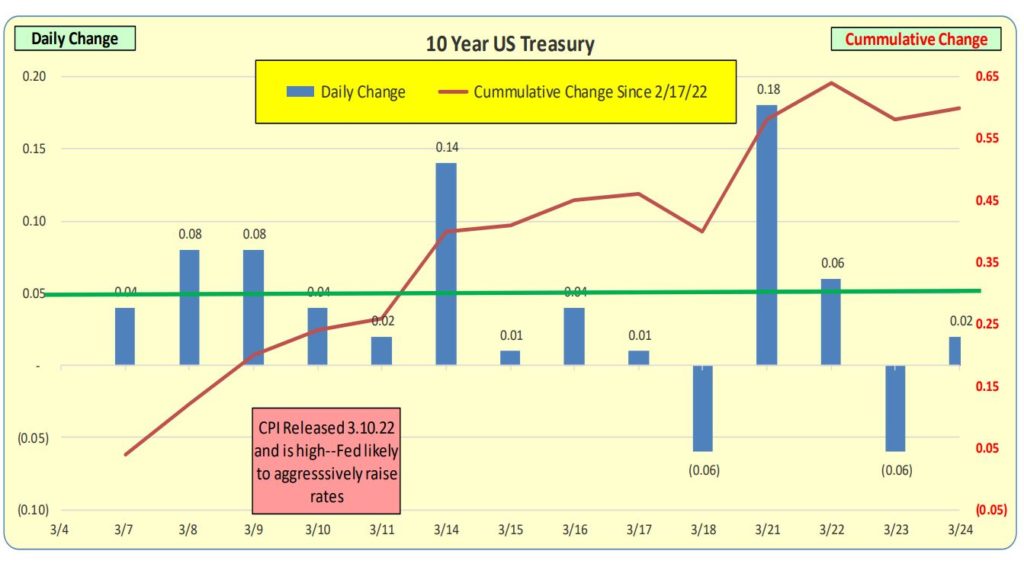

10 year US Treasuries were up 14 bps this past week vs 26 bps for Mortgages. Thus the spread increased by 12 bps to 60 bps ABOVE the long term spread of 168 bps between the two.

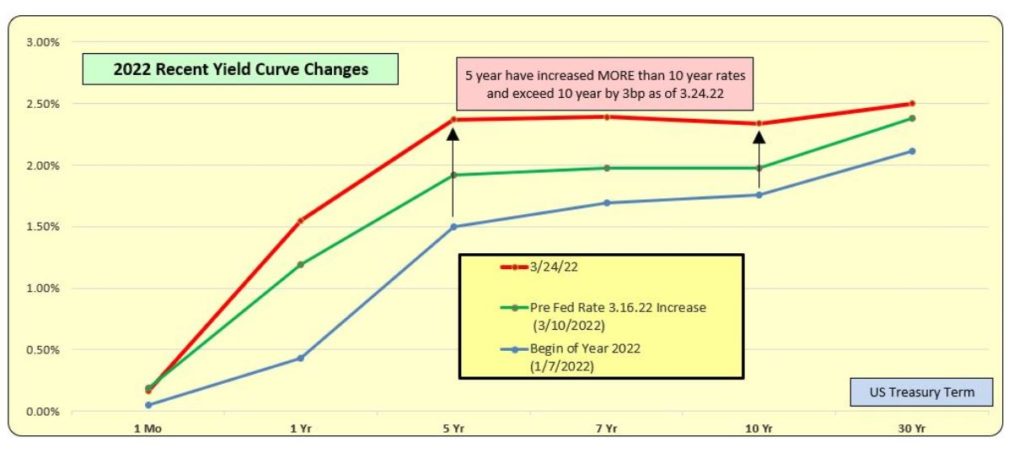

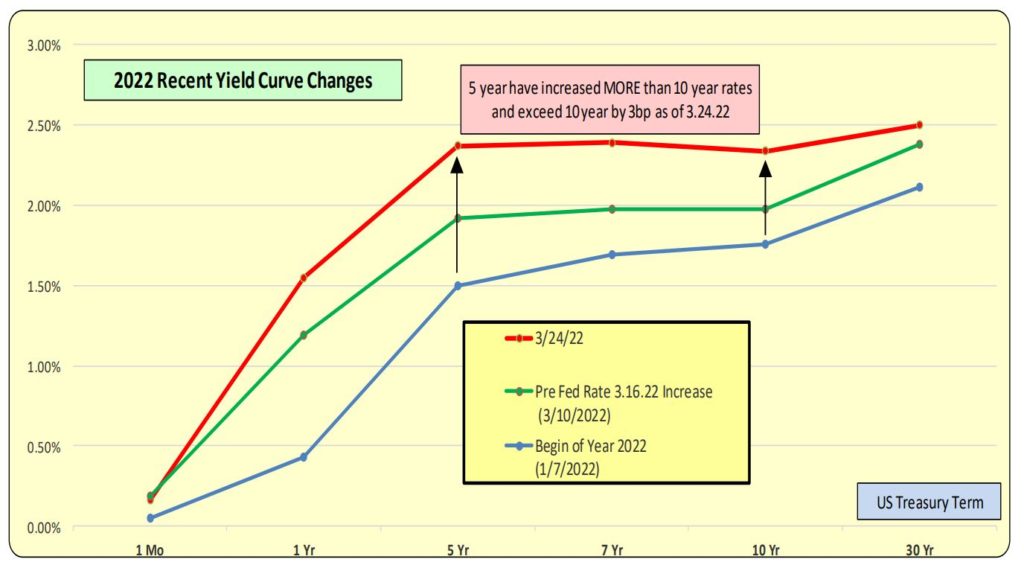

5 year US Treasuries have been increasing faster than 10 year and 5 years are 3 bps above 10 year. To resolve this slight inversion, the 10 years will likely increase faster in the future—thereby putting additional pressure on mortgage rates.

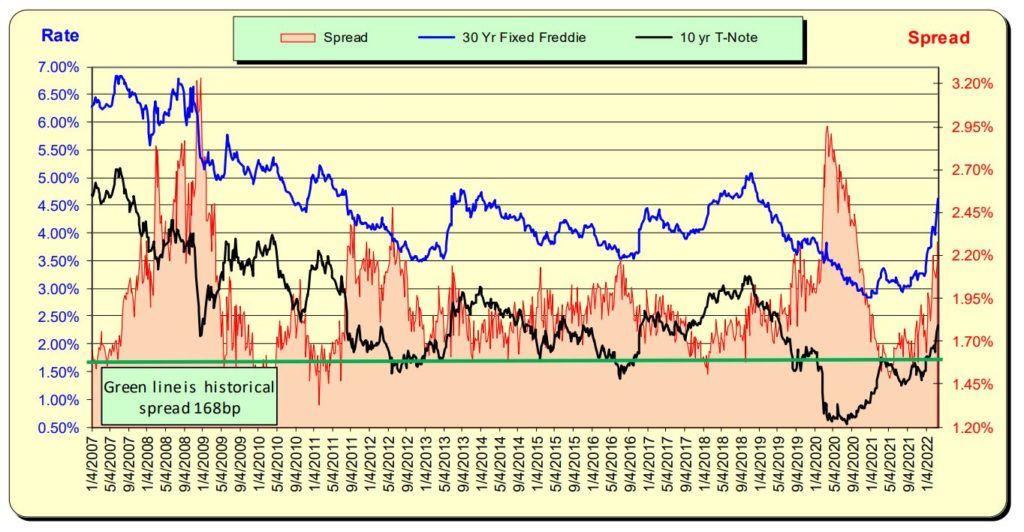

Below are two additional schedules. One shows how the spread between the 10 year US Treasury and mortgage rates have fluctuated over time, it has not been a fixed 168 bps difference. This will not be a recurring item in this weekly publication.

The NEW item has Yield Curves from prior time periods on one graphic. While the first graph does have the rates by term, it did not have a graphic for the yield curve. The fact that 5 year rates exceeded 10 year rates did not jump off the chart, hence I thought it would be best to have a visual. Given the shorter term is higher than the longer term, we will wind up with a “battle of the bulge”. Either longer rates will go up faster than shorter–or—short term will drop faster. Given we are in an increasing rate environment, smart money is on the longer rising faster.

Spread Fluctuation

Cumulative Changes – 60 BPS

Spread: 30 Year Mortgage Rates and 10 Year T-Bill

The green line is the 168 bps historical spread while the pink is current spread. Note how the red line is well above the 168 historical by 60 +168 = 228. While this is higher, there have been many times where the spread has been even larger (usually in periods of rapidly declining 10 year Treasury rates..

Bill Knudson, Research Analyst Landco ARESC