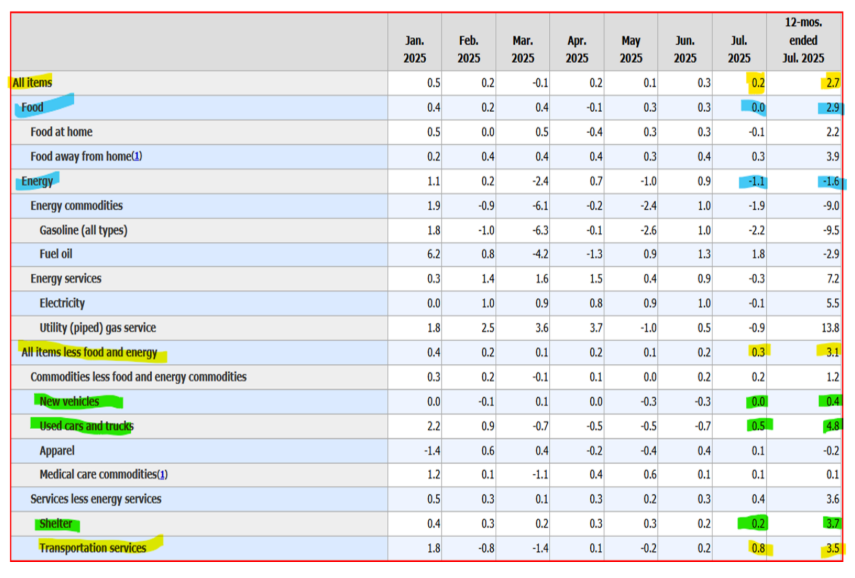

Total CPI: BLS raw data table, far right column is ANNUAL CPI while all other columns are monthly data.

Month of July 2025

Data Release: 8.12.25

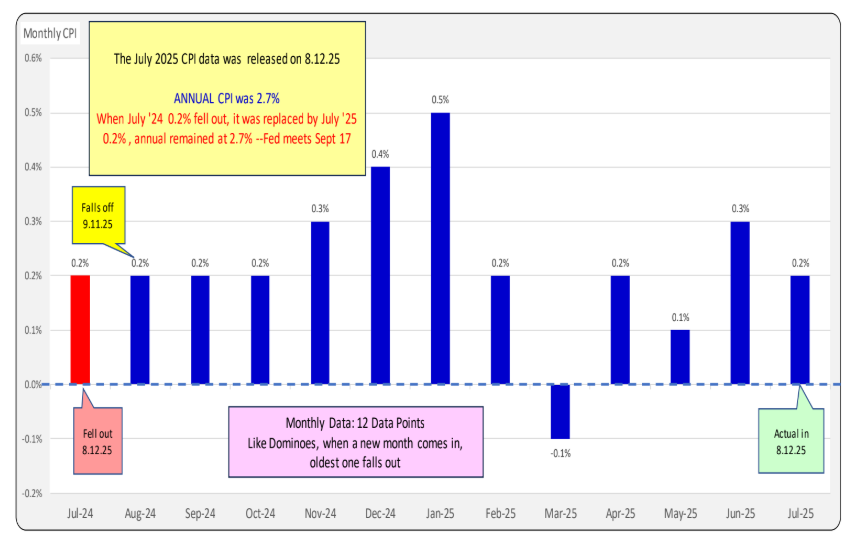

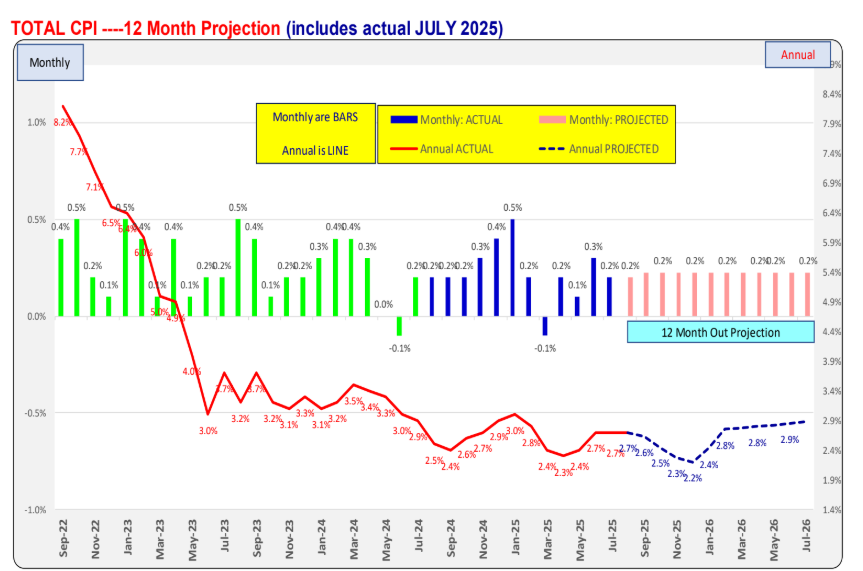

INFLATION: will likely remain the same over the next 3 months—not due to tariffs—rather the older monthly 0.2% data points from late 2024 fall out of the annual CPI calc in the future. It is a guess but if monthly CPI remains at 0.2% for Aug 25 then annual CPI will remain at 2.7% for Aug, Sept and October.

INFLATION: Largest contributor to July monthly increase: Shelter, Medical and Car Insurance & Repair

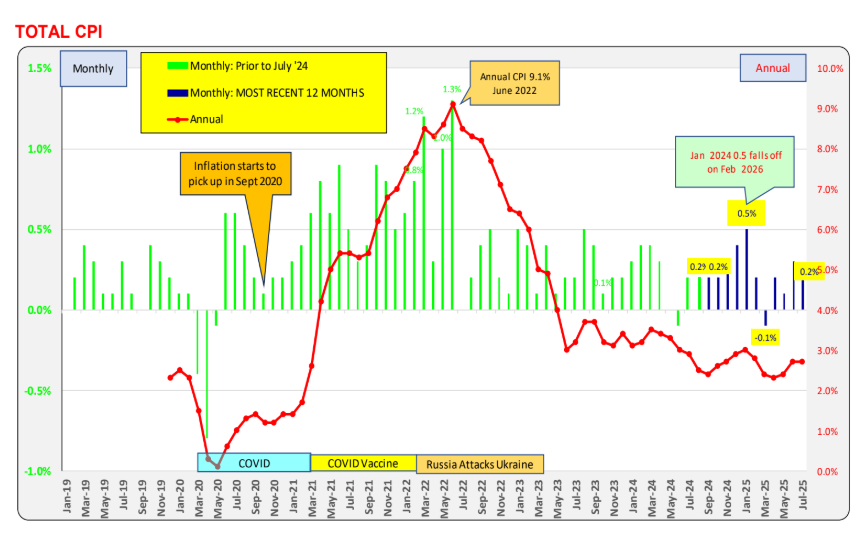

INFLATION Projection: As the large monthly data points in late 2024 fall out, annual inflation will drop but will then increase to 2.9% in spring 2026.

Total CPI: The annual CPI is a rolling product of 12 monthly data points. Think it as being 12 dominoes, as a new one comes on, the oldest one falls off—July 2024’s 0.2% dropped off and was replaced by July 2025 0.0% (blue bar, left axis). This result was no change to the annual CPI which remained at 2.7%. (red line, right axis).

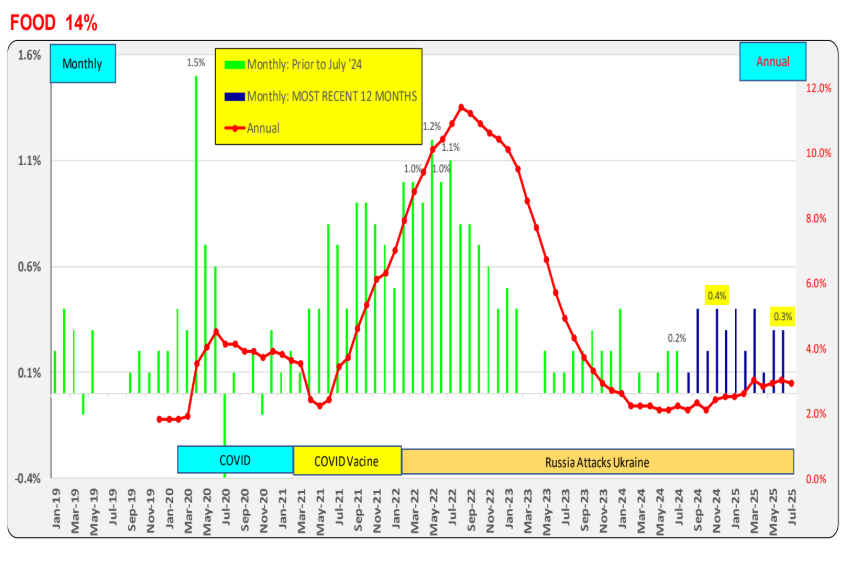

FOOD: Annual CPI for food is price increases are moderate even though egg prices have dropped but lettuce has increased.

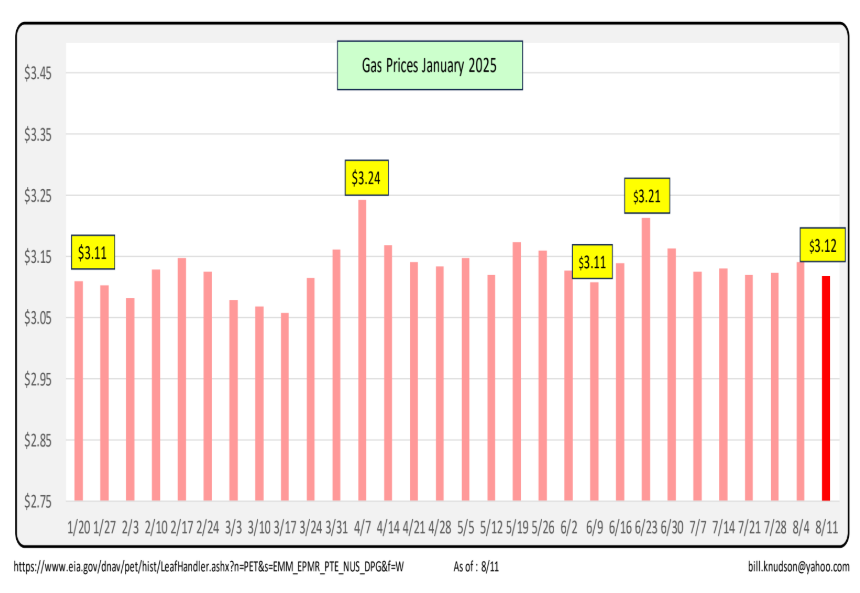

GAS: Since early June gas prices have been very stable.

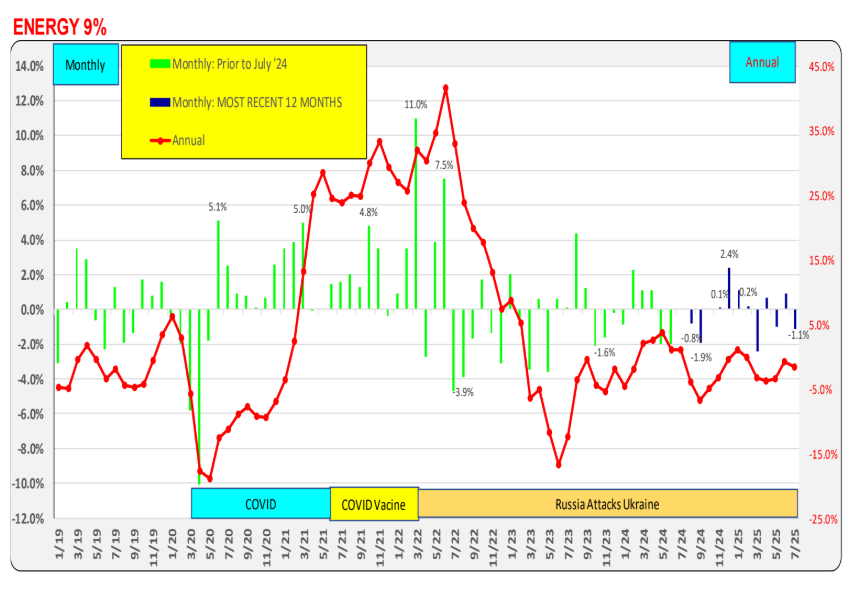

ENERGY: Energy prices have been decreasing while gas prices have been relatively stable.

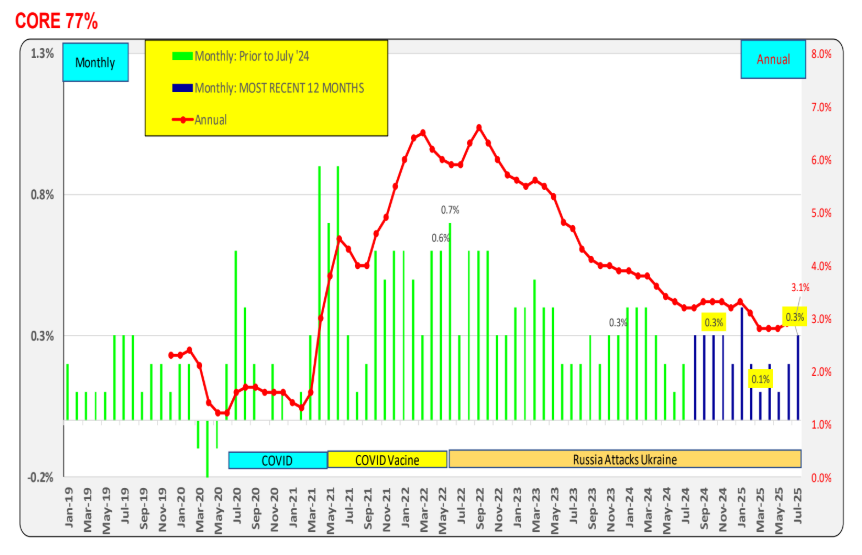

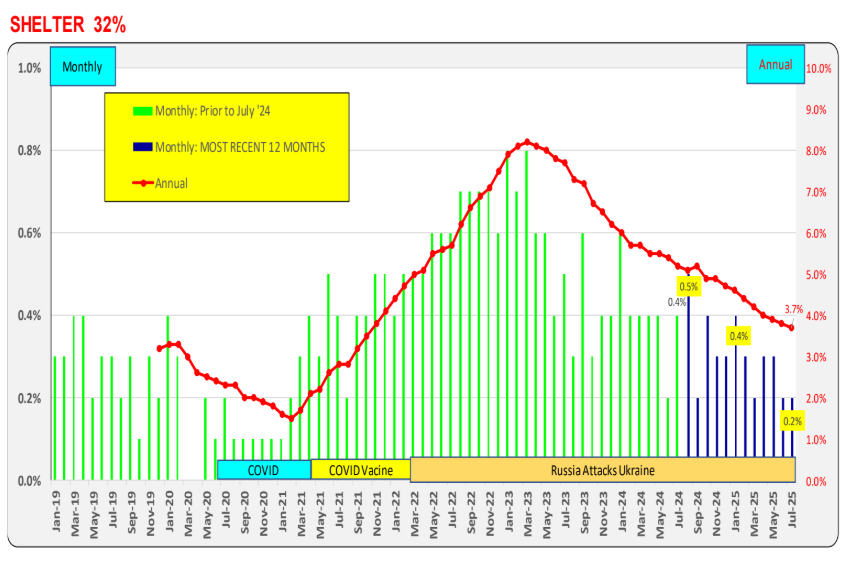

Core CPI: Core represents 77% of all CPI. Of this shelter is the largest component representing 32% of all

consumer expenditures. Core improved slightly as the older bars fell off. Improvements to core will slow over the next few months as shelter improvements slow and other components pick up.

SHELTER: Core Shelter comprises nearly a third of the CPI. Shelter is relatively slow to change. recent

months continue to slowly improve. This large CPI component has been slow to rise and slow to fall.

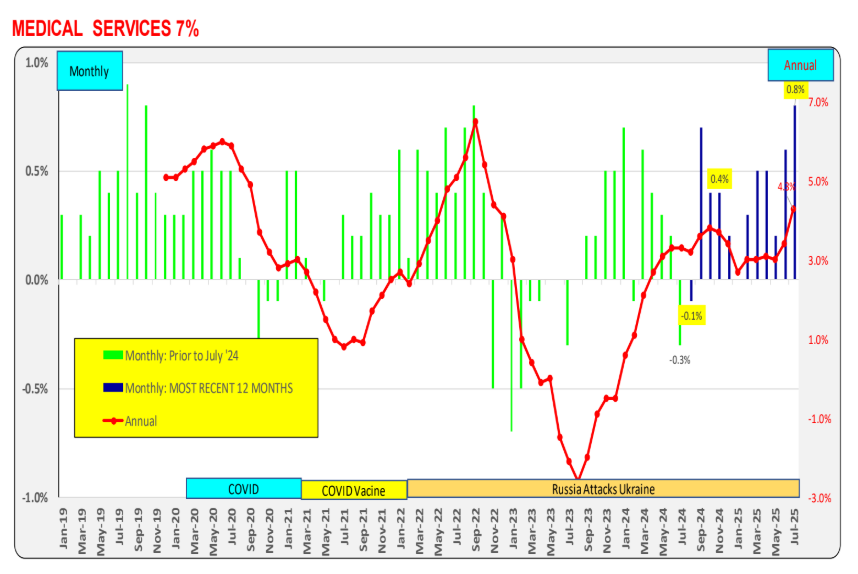

MEDICAL SERVICES: Decreases in Medical Service costs bottom out in mid 2023. It had been a major

contributor to the overall CPI improvement but had started to increase in 2023 accelerated in mid 2025.

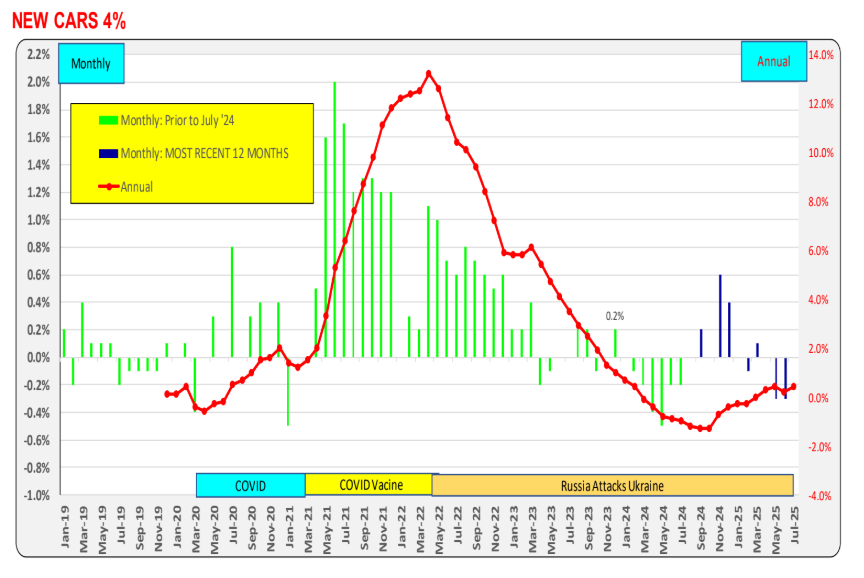

NEW CARS: The slow down in new car prices continues to help the overall CPI improvement. In late 2024 prices have been on a steady slow upward price trajectory.

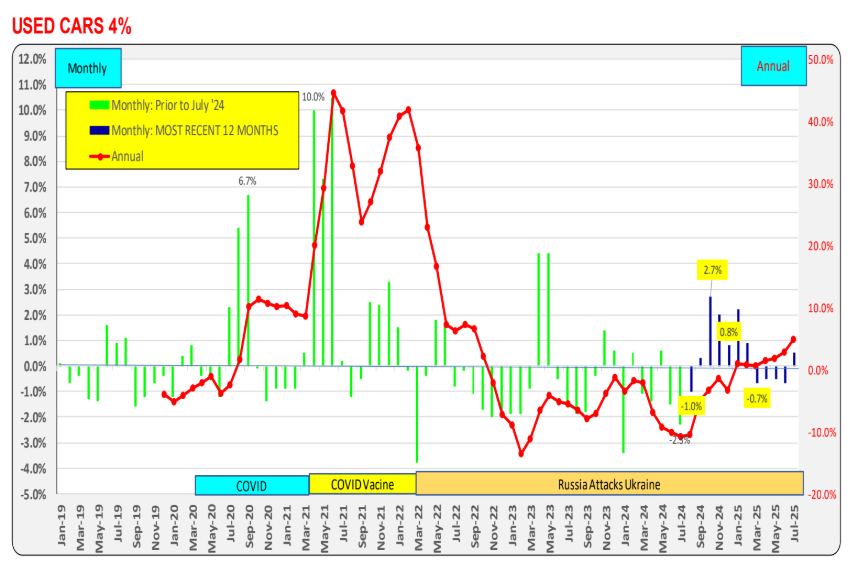

USED CARS: Annual used car prices have trended up over the past 12 months. With elevated new car prices, buyers have turned to the used car market.

Bill Knudson, Research Analyst LANDCO NEXA