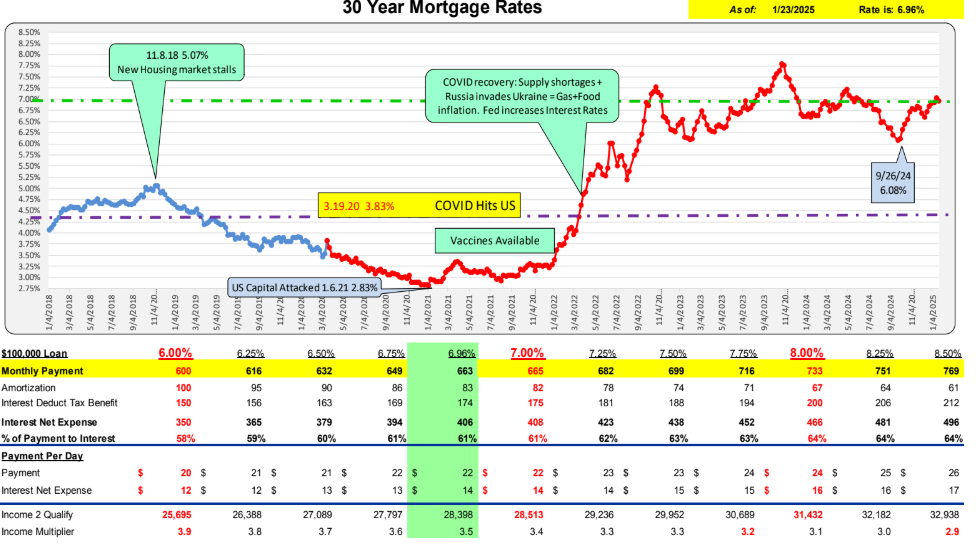

For the week ending 1/23/25, mortgage rates decreased 8bp to 6.96%.

This past week, for a $100,000 loan, the monthly payment decreased from $668 to $663, a reduction of $0.18 per day.

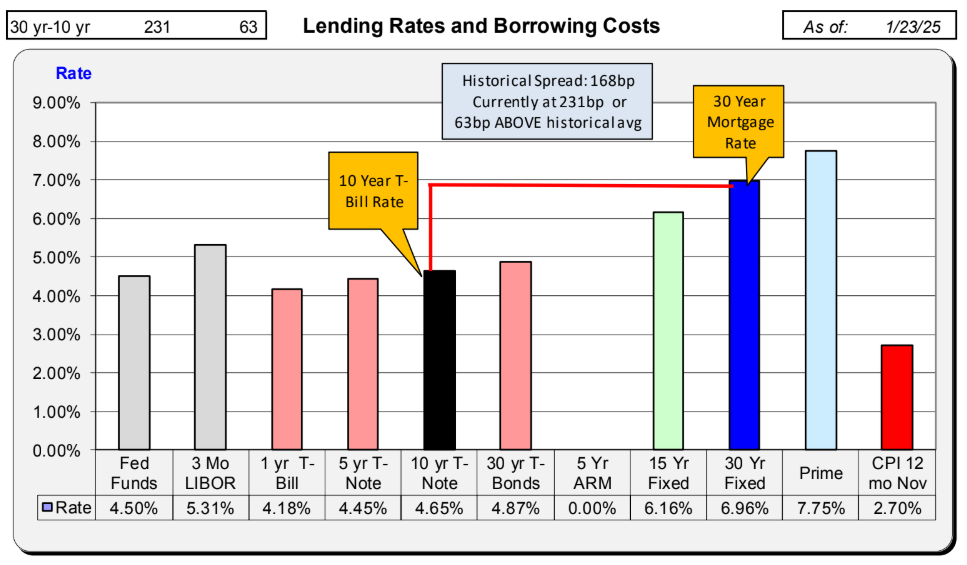

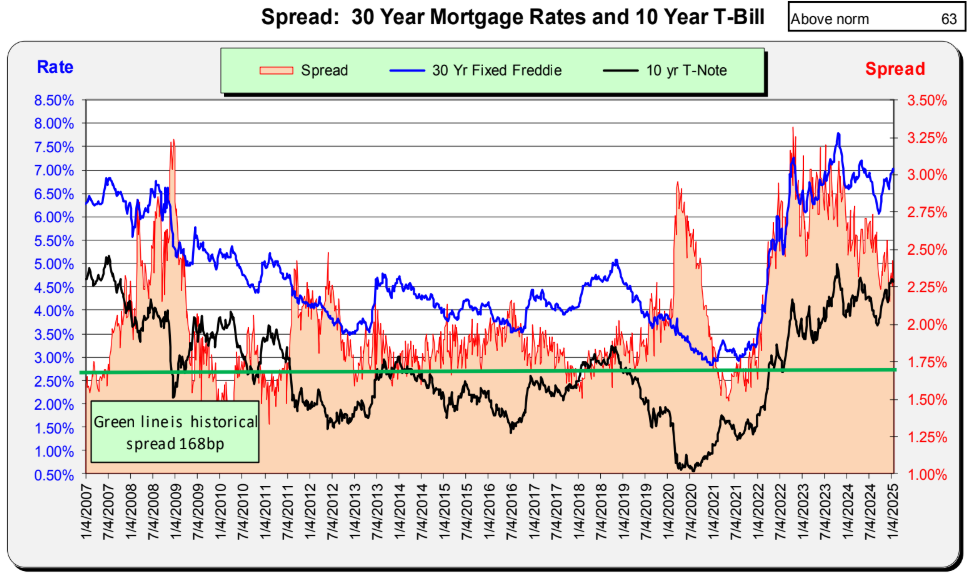

For the week ending 1/23/25, mortgage rates decreased by 8bp, while the 10-Year Treasury rates increased by 4bp. The spread decreased by 12bp to 231bp. With the historical spread at 168bp, there remains a “safety cushion” of 63bp above the historical average.

The historic spread between the 10-Year Treasury and mortgage rates is 168bp (see green line, right axis) and is currently 63bp above the historical norm.

In July, this spread was 150bp. Mortgage rates have decreased more than the 10-Year Treasury.

Bill Knudson, Research Analyst LANDCO NEXA