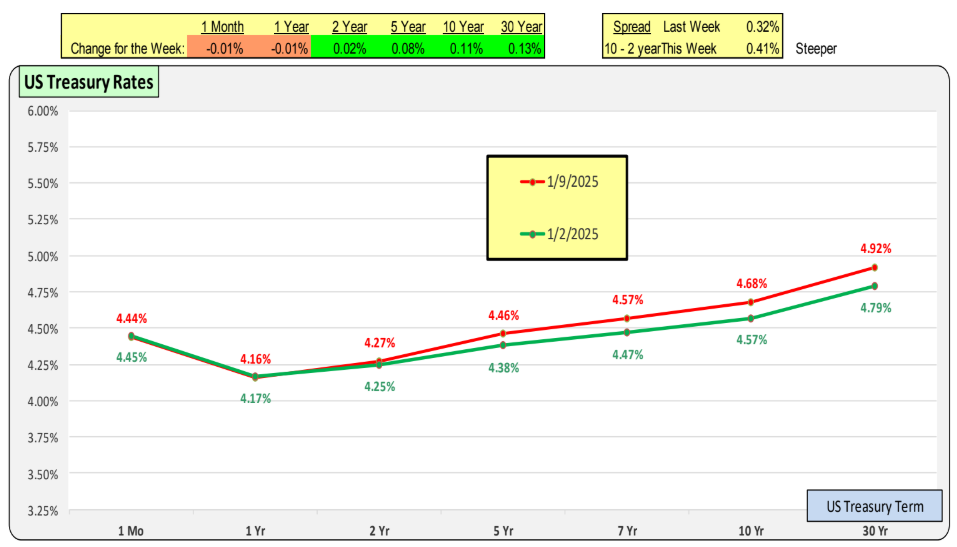

For the week ending 1/9/25, 10-Year Treasury rates increased by 11bp, bringing the net change over the past two weeks to a rise of 9bp.

On the accompanying chart, the red line represents current rates, while the green line shows rates from one week ago. Short-term rates remained unchanged, while long-term rates saw an increase.

For terms of 1 year or more, the yield curve is now displaying a positive shape. As the Federal Reserve continues to lower its Fed Funds rate, short-term rates will decline, allowing the yield curve to return to its historically normal positive slope.

This positive slope in the yield curve reflects a combination of the Fed cutting short-term rates and market dynamics driving demand for higher long-term rates.

Bill Knudson, Research Analyst LANDCO NEXA