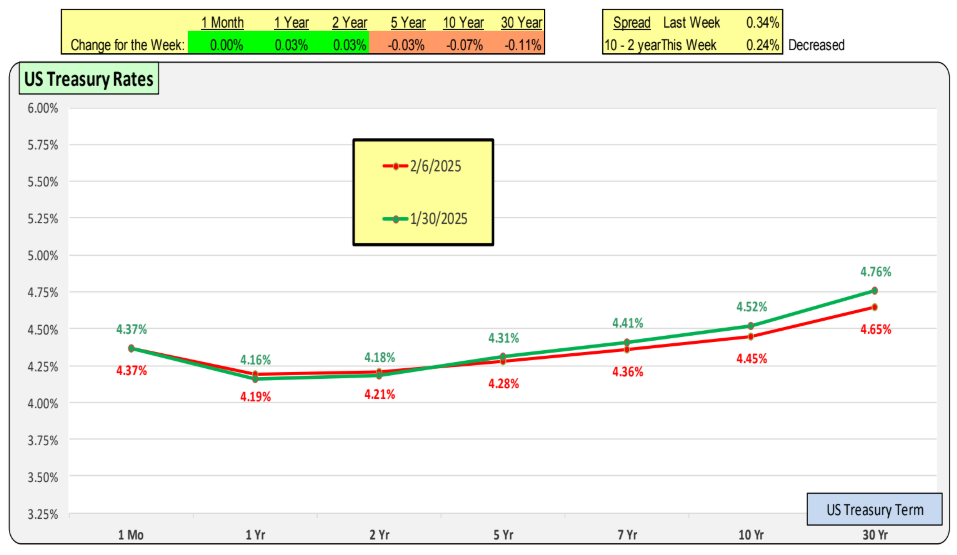

Over the past week, 10-Year Treasury rates declined by 7bps, bringing the net change over the last two weeks to a decrease of 20bps.

The red line represents current rates, while the green line reflects rates from one week ago. Longer-term rates have also moved lower.

For terms of 1 year or more, the yield curve remains positive. As the Fed continues to lower the Fed Funds rate, short-term rates will decline, gradually restoring the yield curve to a more historically typical positive slope.

The positive slope in the yield curve is developing due to a combination of Fed-driven short-term rate cuts and market-driven increases in long-term rates.

Bill Knudson, Research Analyst LANDCO NEXA