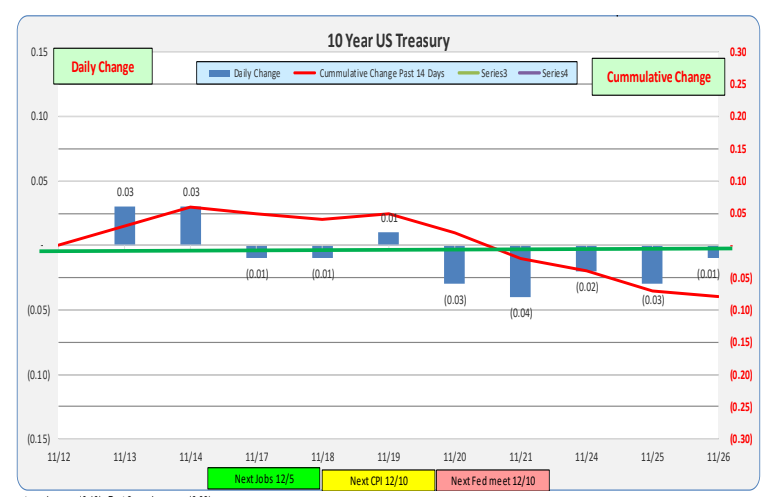

For the past week, 10 Year Treasury rates were down 10bp. Net change in 2 weeks down 8bp. Holiday impacts the 14 day measurement period.

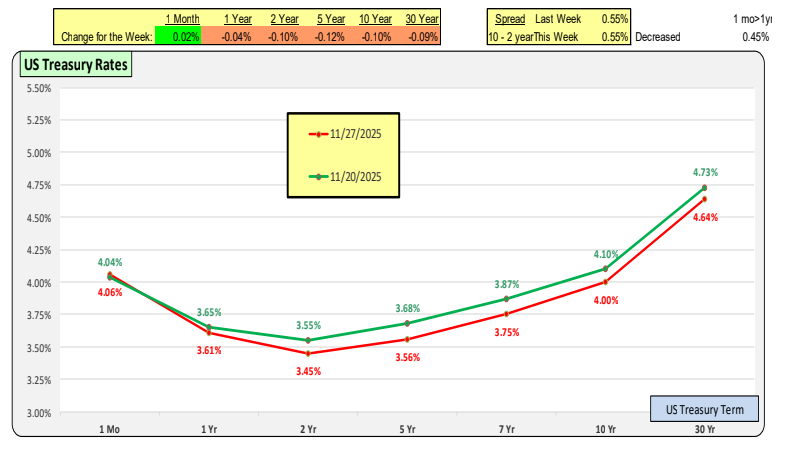

Red line are current rates while green line is one week ago. For longer terms, virtually no changes. Same with 2 year and less. For terms 2+ years, the Yield Curve remains positive. 1 month is 35bp above 1 year. Even if the Fed decreased Fed Funds rate by another 25bp, the very short-term rates would still be higher than longer term. This assumes NO change in ANY longer-term rates from further Fed reductions.

Bill Knudson, Research Analyst LANDCO NEXA